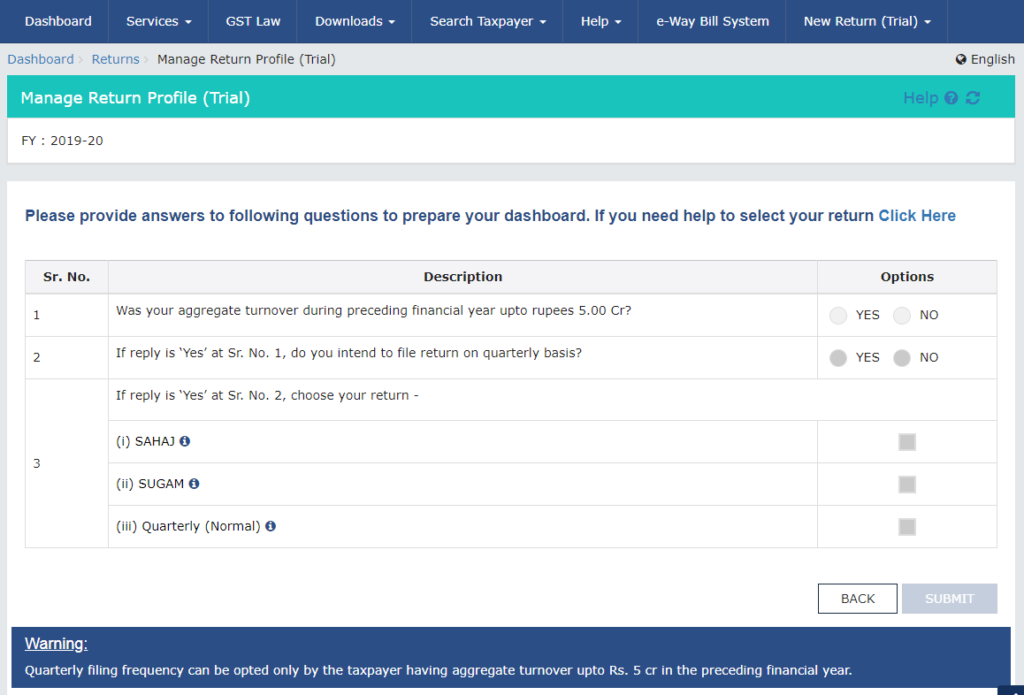

Instruction available on the portal

SAHAJ

Sahaj return may be selected if

- Aggregate turnover during the preceding financial year upto Rs. 5.00 Cr AND

- Make supplies only to consumers, registered persons and unregistered persons (B2C) OR

- Have inward supplies on which tax is payable on reverse charge basis (RCM)

You will be required to:

- Pay tax liabilities on Monthly basis in form GST PMT-08.

- Furnish outward supplies details on continuous basis and cannot claim provisional ITC on Missing invoices.

- File Return on Quarterly basis in GST RET-2.

SUGAM

Sugam return may be selected if

- Aggregate turnover during the preceding financial year upto Rs. 5.00 Cr.

- Make additional outward supplies apart to consumers, unregistered persons and registered persons.

- Have additional inward supplies apart form registered and unregistered persons (including reverse charge).

You will be required to:

- Pay tax liabilities on Monthly basis in form GST PMT-08.

- Furnish outward supplies details on continuous basis and cannot claim provisional ITC on Missing invoices.

- File Return on Quarterly basis in GST RET-3.

QUARTERLY

Quarterly return may be selected if

- Aggregate turnover during the preceding financial year upto Rs. 5.00 Cr.

- Make additional outward supplies apart to consumers, unregistered persons and registered persons.

- Have additional inward supplies apart form registered and unregistered persons (including reverse charge).

You will be required to:

- Pay tax liabilities on Monthly basis in form GST PMT-08.

- Furnish outward supplies details on continuous basis and cannot claim provisional ITC on Missing invoices.

- File Return on Quarterly basis in GST RET-1.

Summary

|

| SAHAJ | SUGAM | NORMAL |

Requirement as per trial return | TAX PAYMENT | Monthly basis in form GST PMT-08 | Monthly basis in form GST PMT-08. | Monthly basis in form GST PMT-08 |

RETURN FORM | GST RET-2 | GST RET-3 | GST RET-1 | |

ITC CLAIM | cannot claim provisional ITC on Missing invoices | cannot claim provisional ITC on Missing invoices | cannot claim provisional ITC on Missing invoices | |

OUTWARD UPLOADING | continuous basis | continuous basis | continuous basis | |

Selection as per trial return | Quarterly selection | turnover during the preceding FY upto Rs. 5.00 Cr | turnover during the preceding FY upto Rs. 5.00 Cr | turnover during the preceding FY upto Rs. 5.00 Cr |

| Make supplies only to consumers, registered persons and unregistered persons (B2C) | Make additional outward supplies apart to consumers, unregistered persons and registered persons | Make additional outward supplies apart to consumers, unregistered persons and registered persons | |

| Have inward supplies on which tax is payable on reverse charge basis (RCM) | Have additional inward supplies apart form registered and unregistered persons (including reverse charge) | Have additional inward supplies apart form registered and unregistered persons (including reverse charge) | |

Points to be noted | As per proposed return docs | outward supply under B2C category and inward supplies attracting reverse charge only. | outward supply under B2C and B2B category and inward supplies attracting reverse charge only | all types of outward supplies, inward supplies and take credit on missing invoices. |

Our Views:

In Sahaj, only B2C sale can be reported. Hence it will be suitable for composition dealers.

In Sugam, B2B & B2C both can be reported but ITC has to be claimed on auto populated basis. You can add new inward supply bills if your vendor has not filed return. Hence it will less popular return. May be suitable for those in service industry not having inward supply or trading/manufacturing entity whose inward supply are from unregistered dealer only. But These category may be very little.

In Normal Return, You can add all types of sales. Most important: Missing inward supply bills can be added and provisional credit can be claimed on it. Hence most of the dealer will prefer Normal Return.

Those who select quarterly return may note that tax has to be paid on monthly basis in PMT-08. Details of Tax on outward supply, Tax on inward RCM, and ITC claimed need to be reported in PMT-08.

If you need not to pay tax even though you have to file a declaration on monthly basis.

Share this:

- Click to share on WhatsApp (Opens in new window) WhatsApp

- Click to share on Telegram (Opens in new window) Telegram

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to print (Opens in new window) Print